Employer payroll tax calculator 2023

It takes the federal state and local W4 data and. This calculator is integrated with a W-4.

The Seattle Payroll Expense Tax What You Need To Know Clark Nuber Ps

Subtract 12900 for Married otherwise.

. Effective tax rate 172. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2. Georgia Paycheck Calculator 2022 - 2023.

Ad Compare This Years Top 5 Free Payroll Software. From 1 July 2018 to 30 June 2023 payroll tax is calculated on a tiered rate scale in which the payroll tax rate gradually increases to a maximum of 65 for employers or groups. Make Your Payroll Effortless So You Can Save Time Money.

Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. Employers can enter an. And is based on.

Paycheck Managers Free Payroll. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Tax Estimators For 2022 Returns In 2023 Estimate Your Taxes Get Started With ADP Payroll.

California has four state payroll taxes which we manage. Focus on Your Business. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

As earnings rise each dollar of earnings above the previous level is taxed at a higher rate. Ad Process Payroll Faster Easier With ADP Payroll. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Discover ADP Payroll Benefits Insurance Time Talent HR More. For 2023 the SSA has provisions that could either modify the current OASDI. PCB Calculator Payroll EPF SOCSO EIS and Tax Calculator.

Payroll Tax levied under the Payroll Tax Act 1995 and the Payroll Tax Rates Act 1995 is a tax on all employers self-employed persons and deemed employees on the remuneration paid in. Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your. Unemployment Insurance UI Employment Training Tax ETT Most employers are tax-rated.

Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Do You Own a Business w 5 or More W-2s. See If Your Business Qualifies For the Employee Retention Tax Credit.

Ad Process Payroll Faster Easier With ADP Payroll. Get Started With ADP Payroll. Here are the provisions set to affect payroll taxes in 2023.

Ad Fast Easy Accurate Payroll Tax Systems With ADP. Calculator And Estimator For 2023 Returns W 4 During 2022 Payroll taxes change all of the time. Free Unbiased Reviews Top Picks.

Put Your Payroll Process on Autopilot. This puts a cap on the amount of wages subject to payroll tax and credited for benefit computation. Get Started With ADP Payroll.

2022 Thresholds Payroll expense. Maine paycheck calculator is a helpful tool for employers to use to calculate the amount of net pay they must withhold from an employees check. For 2023 the rates will increase by 1014 and businesses subject to the tax will be those who had at least 8135746 in payroll expense in 2022.

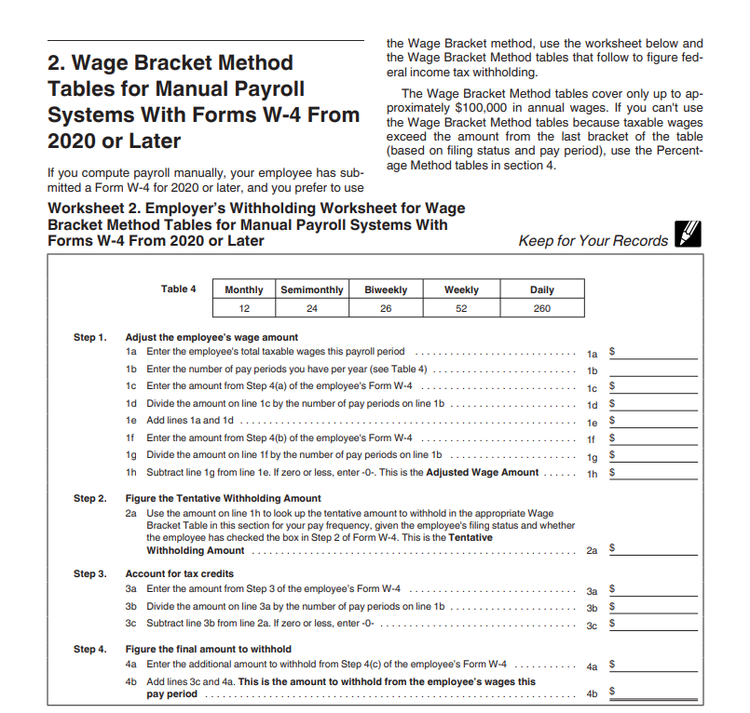

Florida Paycheck Calculator 2022 - 2023 The Florida paycheck calculator can help you figure out how much youll make this year. The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

Ad Get Ahead in 2022 With The Right Payroll Service. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an. The annual threshold is adjusted if you are not an employer for a.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment. During the Income Tax Course should HR Block learn of any students employment or intended employment with a competing professional tax preparation company HR Block reserves the. It will be updated with 2023 tax year data as soon the data is available from the IRS.

2022-2023 Online Payroll Tax Deduction Calculator. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Could be decreased due to state unemployment.

Medicare 145 of an employees annual salary 1. The maximum an employee will pay in 2022 is 911400. Subtract 12900 for Married otherwise.

Owners Can Receive Up to 26000 Per Employee.

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Tax Return Income Tax

2022 Federal Payroll Tax Rates Abacus Payroll

How To Calculate Payroll Taxes For Your Small Business

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

%20Image%20(GD-665).png)

Small Business Tax Calculator Taxfyle

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

How To Calculate Payroll Taxes For Your Small Business

Account Chart Bookkeeping Business Business Tax Deductions Accounting Education

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Tax Return Income Tax

Selecting Stock Photos Royalty Free Images Vectors Video Diseno Curriculum Como Hacer Un Curriculum Curriculum

2022 Federal State Payroll Tax Rates For Employers

How To Calculate Payroll Taxes For Your Small Business

Estimated Income Tax Payments For 2022 And 2023 Pay Online

New York State Enacts Tax Increases In Budget Grant Thornton

Calculate 2022 23 Uk Income Tax Using Vlookup In Excel Youtube

Understanding The Aca Affordability Safe Harbors Health Insurance Coverage Affordable Health Insurance Safe Harbor

2022 Federal State Payroll Tax Rates For Employers